Real Cost of Buying Your First Home in Melbourne

It’s easy to fall in love with the dream of buying your first home – but it’s the numbers that can quickly bring you back to reality. Between deposits, stamp duty and the extras that don’t make the brochure, the path to ownership can feel like a maze.

That’s why it helps to look beyond the listing price. From upfront fees to the costs that come after settlement, understanding the full picture is key to buying with confidence. Knowing what to expect – and planning for it early – can make the journey to home ownership far smoother.

Understanding home deposit requirements: How first-home buyers can enter the market with a 5% deposit and avoid LMI costs.

Beyond the deposit

Thanks to government initiatives like the First Home Buyer Guarantee, eligible buyers can now purchase with as little as a 5% deposit – without paying Lenders Mortgage Insurance (LMI). That’s a potential saving of tens of thousands, helping buyers step into the market sooner.

For those who don’t qualify, most banks and lenders will typically require between 5% and 20% of the property’s value. On a $700,000 home, that means saving between $35,000 and $140,000 upfront.

If your deposit is under 20% and you don’t qualify for the scheme, LMI comes into play – a one-off cost that protects the lender, not the borrower. Depending on the loan amount, it can add $10,000 to $15,000 or more to the total borrowed. It’s often rolled into the loan itself, meaning higher repayments over time.

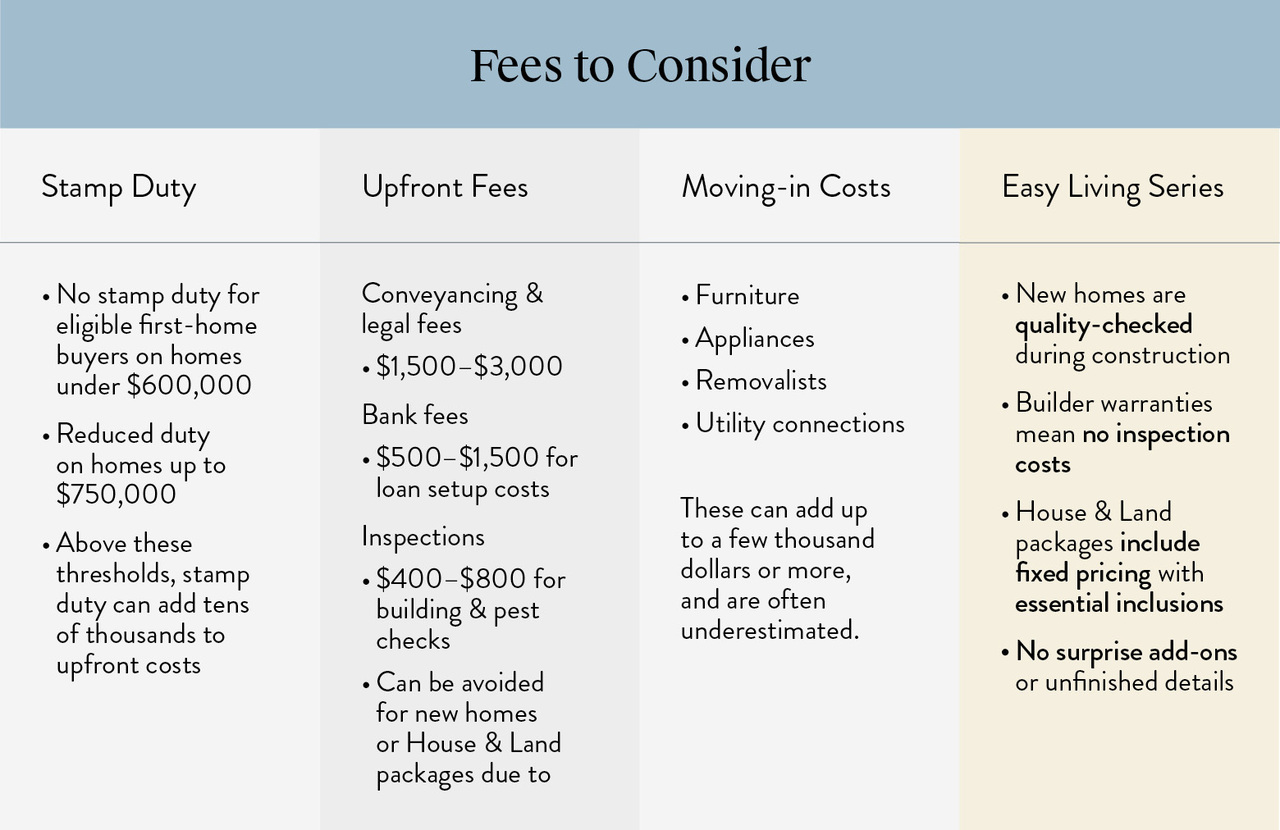

Stamp duty savings and key upfront costs first-home buyers need to budget for in Victoria.

Stamp duty and fees

In Victoria, eligible first-home buyers pay no stamp duty on homes under $600,000, and reduced duty on homes up to $750,000. Outside these thresholds, stamp duty can add tens of thousands to your upfront cost.

You’ll also need to factor in:

- Conveyancing and legal fees: ballpark of $1,500–$3,000

- Bank fees: between $500–$1,500 for loan setup costs

- Inspections: approximately $400–$800 for building and pest checks

If you’re buying a new home or House & Land package, you can potentially skip the cost of building and pest inspections, since your home is covered by builder warranties and quality-checked throughout construction. It’s a small but meaningful saving, and one of the many ways new builds like Carlisle’s EasyLiving Series offer such strong value for money.

Moving in and settling in

Once the keys are in hand, the next wave of expenses begins, and these should be planned for. Furniture, appliances, removalists, and utility connections can quickly add up to a few thousand dollars or more. Many first-home buyers underestimate this stage, but being prepared makes the transition much smoother.

Carlisle’s EasyLiving Series helps take the guesswork out of this step, with House & Land packages that include fixed pricing covering essential inclusions, ensuring no surprise add-ons or unfinished details when you move in.

Carlisle’s EasyLiving Series offer premium inclusions, transparent pricing and finance support for first-home buyers.

The Carlisle advantage

Buying your first home shouldn’t feel like a maze of costs and fine print. Carlisle’s value-focused EasyLiving homes are designed to make ownership more transparent, attainable and rewarding.

Every home comes with premium inclusions – think designer kitchens, spacious living zones, stone benchtops and quality finishes that elevate everyday living – so buyers know exactly what they’re getting from day one.

With trusted finance partners and guidance through the First Home Buyer Guarantee process, Carlisle helps buyers take control of their budget and move forward with confidence.

Take the next step

For first-home buyers, clarity and confidence make all the difference. Carlisle’s EasyLiving Series House & Land packages offer a straightforward path to ownership – quality family homes, premium inclusions and trusted support from contract to keys.

Explore available packages or visit an EasyLiving display home today to see how close your new home could be.