The Finance Essentials: Understanding How Much You Can Borrow

When you’re planning to buy or build a home, one of the biggest questions is: how much can I actually borrow?

In the third episode of The Finance Essentials, Carlisle Homes team up with industry expert Mark Polatkesen, Managing Director of Mortgage Domayne, to unpack borrowing capacity—what it is, what shapes it, and, importantly, what you can do to improve it.

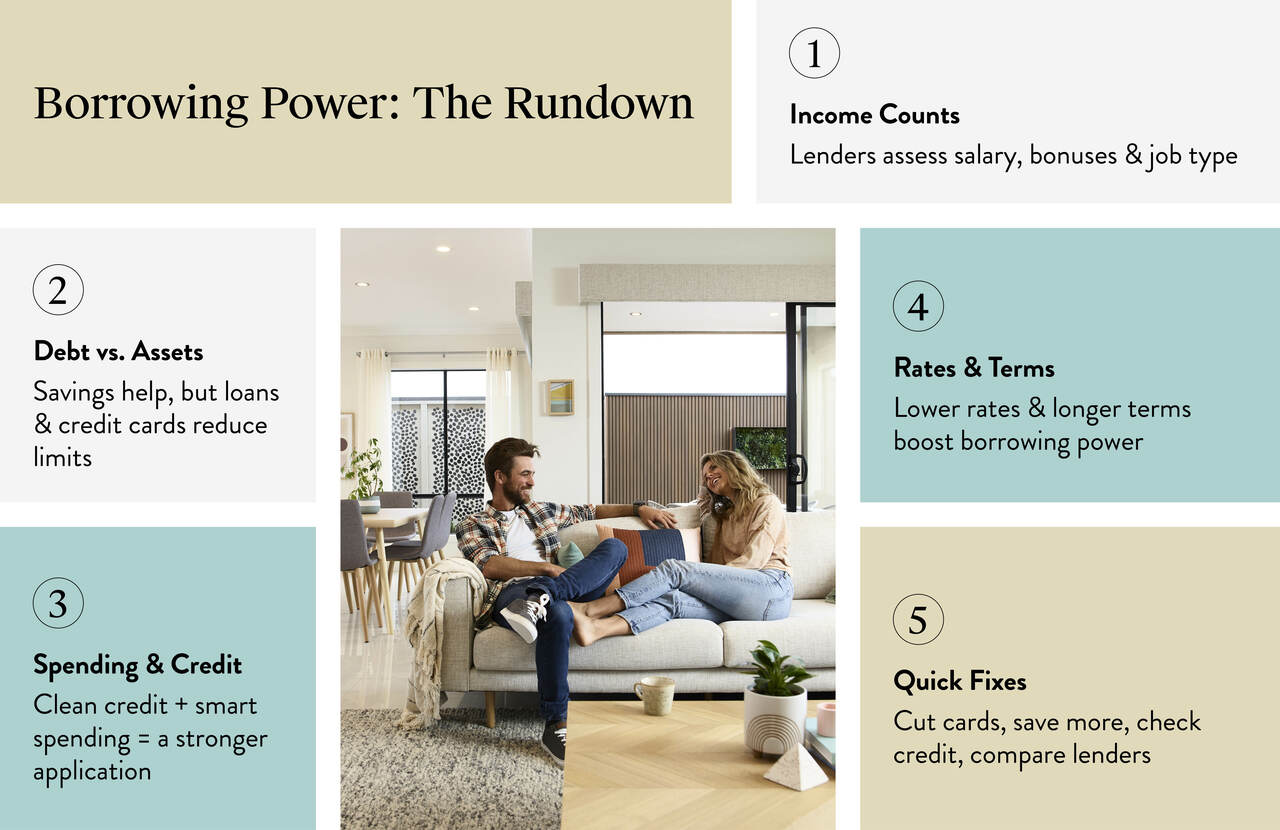

Here’s a quick look at the key factors influencing borrowing capacity, along with some smart tips to help boost yours.

Watch now: Understand the key factors that influence your borrowing capacity.

Watch now: Understand the key factors that influence your borrowing capacity.

Income and type of employment

Your income is one of the biggest drivers of how much you can borrow. Lenders look at your salary, rental income, overtime, bonuses, and any government payments, plus your employment type—whether you’re full-time, part-time, casual, or self-employed. For the self-employed, tax returns and business profits carry a lot of weight, so keeping your records neat and up-to-date is key.

Assets and liabilities

Lenders will weigh up your assets, such as savings, investments, and superannuation balance, against your liabilities, like car loans, personal loans, and credit cards. Even an unused credit card with a high limit can chip away at your borrowing power, as the bank treats it as potential debt. Trimming back on unnecessary accounts or lowering limits can make a real difference.

Credit report and expenses

A clean credit report works in your favour, while late payments or defaults can put a dent in your application. Banks also look closely at everyday spending, from groceries and childcare to subscriptions and those little splurges. If you’ve had a one-off expense like a holiday or a big purchase, flagging it as a one-off can help paint a clearer and fairer picture of your spending habits.

These are the key factors that influence your borrowing capacity.

Interest rate and loan term

Interest rates directly impact your borrowing capacity: higher rates mean higher repayments, typically reducing the amount a bank will lend. Choosing a longer loan term, like 30 years instead of 25, can stretch your borrowing capacity by lowering monthly repayments, though it will mean paying more interest over time.

Small changes, big impact

Want to increase your borrowing power? A few minor tweaks can help: cut back unused credit cards, tidy up your expenses, build up your savings, and check your credit score before applying. And don’t forget to shop around as different lenders have different borrowing limits, so doing your homework or speaking with a mortgage expert can really pay off.

Watch Episode Three of The Finance Essentials for practical, expert-led advice on boosting your borrowing power and getting closer to your dream home. Head to the Carlisle Homes website for more finance tips.