Construction loans made simple for first-time builders

When it comes to building a new home, the excitement often goes hand-in-hand with confusion—especially around financing. Thankfully, there’s now a straightforward way to cut through the complexity.

The Finance Essentials is a new three-part video series from Carlisle Homes that simplifies the ins and outs of home finance, helping prospective homeowners feel confident about the financial decisions they need to make. In the first episode, the focus is on construction mortgages, a type of loan tailored explicitly for new builds and major renovations.

Watch now: Discover the smart way to finance building your dream home!

Watch now: Discover the smart way to finance building your dream home!

What exactly is a construction mortgage?

Think of a construction mortgage as a home loan designed specifically for new builds. Rather than handing over the entire loan amount upfront (like a regular mortgage), the lender releases money in stages that match each construction phase. The bonus here? Homeowners only pay interest on the amount they’ve already used, making repayments friendlier on the wallet in the early stages.

How does it differ from a regular home loan?

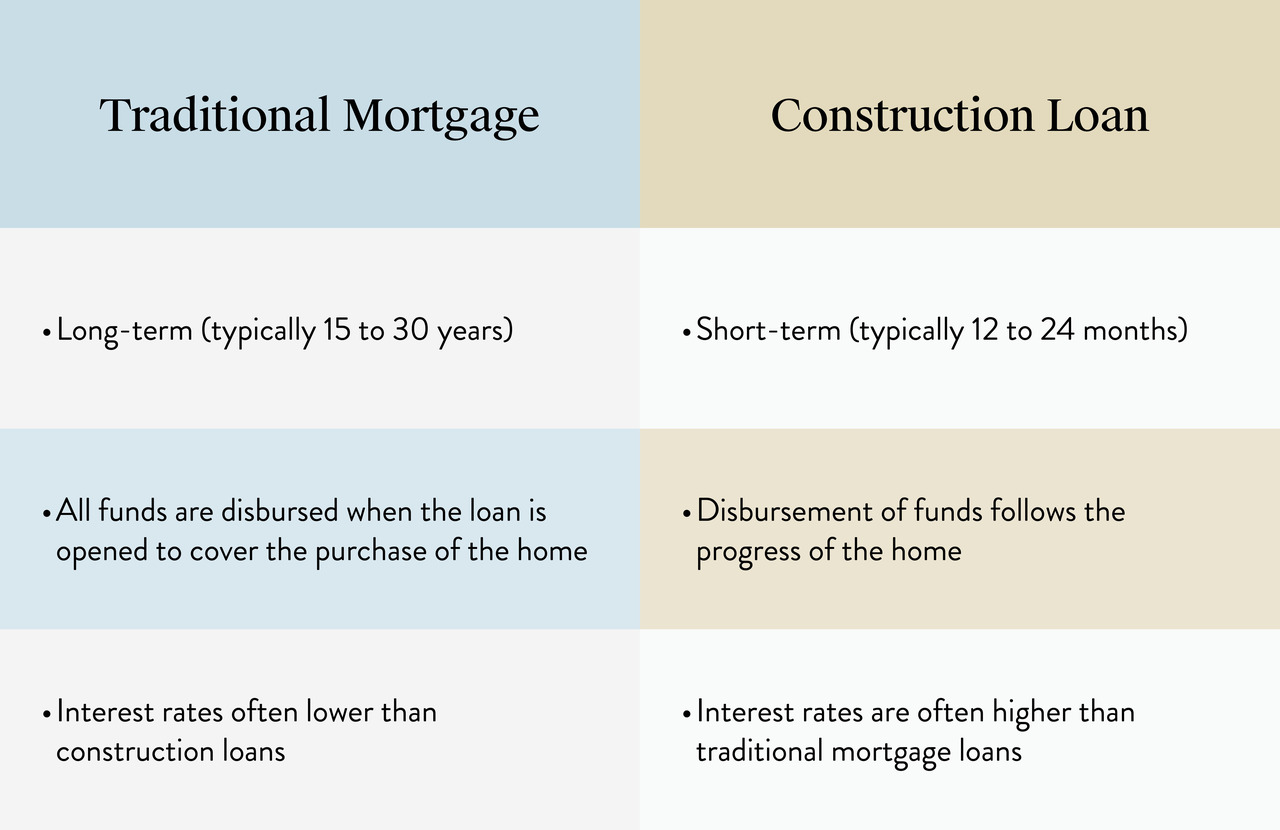

Unlike regular mortgages, where borrowers get the full amount immediately and start paying interest from day one, construction mortgages release funds gradually. Borrowers only pay interest on what’s been drawn down, rather than on the full loan amount right away. It’s like paying as you go, keeping payments lower while the dream home takes shape.

Construction loans offer many additional benefits compared to traditional mortgages when it comes to building your home. Watch Now: to find out why.

What are the benefits?

There’s plenty to love about construction mortgages. Firstly, repayments start lower, increasing slowly as the build progresses, which means fewer financial headaches. Additionally, staged payments come with built-in security, as lenders check that the build stays on track before releasing funds. Ultimately, this approach can lead to significant savings in interest payments throughout construction, putting more money in your pocket for the finishing touches.

Is the application process the same as a regular home loan?

The application process is similar, but construction mortgages have some additional steps. Alongside standard pre-approval, lenders will want detailed building plans and a fixed-price contract from the builder. Before releasing payments, they’ll also perform regular inspections at key construction stages—like when the slab goes down or the framing goes up. After construction wraps up, the loan conveniently transitions into a standard principal-and-interest mortgage.

Watch Episode One of The Finance Essential Series now and get clear, practical advice on financing your new build. Then, take the next step with confidence using the finance calculators on the Carlisle Homes website.