Big Changes Ahead for the First Home Guarantee Scheme

The First Home Guarantee Scheme has been a helping hand for buyers eager to get into the market for several years now, helping Australians purchase their first home with as little as a 5% deposit and without the added cost of Lenders Mortgage Insurance (LMI).

From 1 October 2025, the scheme is set to become even more flexible. With unlimited places, higher property price caps, and the removal of income thresholds, it’s evolving to reflect today’s market realities.

For first home buyers, that means more choice, less red tape, and a smoother path to home ownership. Here’s everything you need to know.

First Home Guarantee Scheme update from 1 October 2025: unlimited places, higher price caps, no income limits, and easier access for first home buyers.

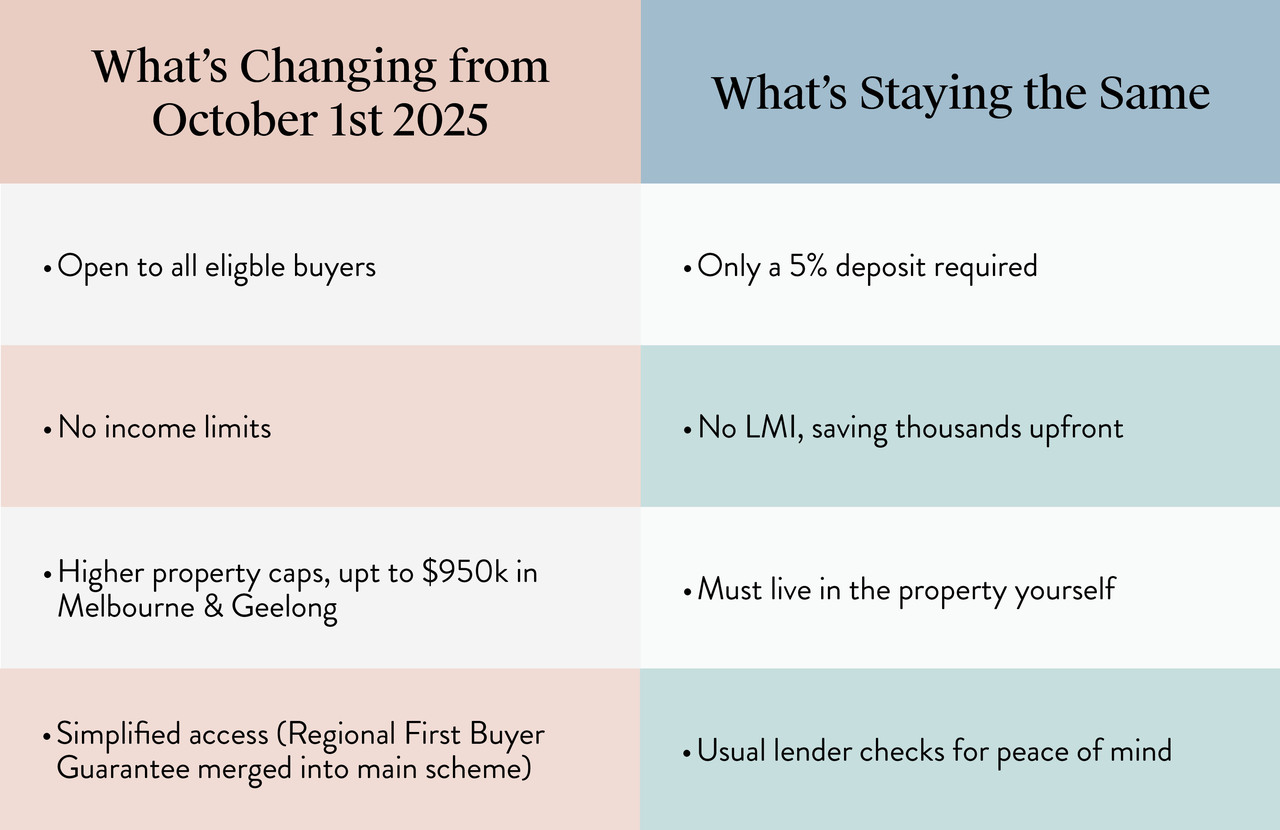

Key updates at a glance

The First Home Guarantee is getting a major facelift. From 1 October, here’s what’s changing:

- Unlimited places – no more rushing to secure one of the limited 35,000 spots. The scheme will now be open to all eligible buyers, whenever they’re ready to apply.

- No income limits – higher-earning households who were previously locked out can now take advantage, widening the scheme’s reach and making it relevant for a broader group of buyers.

- Higher property price caps – adjusted to reflect today’s property values. In Melbourne, the cap will jump to $950,000, covering metropolitan Melbourne and Geelong, opening the door to a much greater choice of homes across more suburbs.

- Simplified access – the Regional First Home Buyer Guarantee will now be folded into the main scheme, making it easier for buyers to understand and access, no matter where you’re buying.

What’s staying the same

The updates are exciting, but some of the scheme’s most important criteria are sticking around – which is good news if you’ve already considered it as your way into your first home.

You’ll still:

- Need a minimum 5% deposit – the scheme’s biggest perk, helping buyers sidestep the usual 20% deposit hurdle if wanting to avoid paying LMI.

- Live in the property yourself – it must be your main residence, not an investment property.

- Meet your lender’s usual checks – things like borrowing capacity, savings history, and credit checks will still apply, just as with any home loan.

First Home Guarantee: Buy with 5% deposit, no LMI, and access more homes under higher price caps — giving buyers more choice and flexibility.

What this means for buyers

The biggest win is flexibility. Eligible buyers can purchase with as little as a 5% deposit while skipping the hefty cost of LMI – a saving that could shave tens of thousands off your initial loan amount and literally years off the savings timeline, helping you step into your first home much sooner.

It also opens the door to more people: couples with stronger incomes, singles looking closer to established amenities, or families chasing a little more space.

With higher property price caps, more established homes, townhouses and turnkey house-and-land packages now fall within reach – especially in growth corridors. In practice, that means a much wider pool of listings will “qualify,” giving buyers more choice at realistic prices.

Expanded First Home Guarantee makes buying easier. Carlisle house and land packages offer fixed-price inclusions, modern designs, and great value for first-home buyers.

The opportunity in today’s market

Buying a home has always been about timing, and right now the stars are aligning for first-home buyers. The expanded scheme makes it easier to buy into communities with real growth potential, whether that’s a brand-new greenfield estate or a location closer to your heart.

Carlisle’s house and land packages are a natural fit here – from value-packed EasyLiving homes designed with first-time buyers in mind, to select Inspire and Affinity Collection packages that now sit comfortably within the new price limits. With fixed-price inclusions and floorplans tailored to modern living, it’s a smarter, more straightforward way to secure your first home.

Your first home, made easier

From 1 October, the path to homeownership is clearer than ever. Explore Carlisle’s EasyLiving, Inspire and Affinity ranges and see how the expanded First Home Guarantee can help turn your deposit into a door key.