How Much Do You Need to Earn to Afford the Median Home?

Not sure how much you need to save for a new home? We’ve got plenty of insight into median house prices – and few tips on avoiding mortgage stress.

If you’re trying to set a budget for your first home, you may be wondering what you can really afford. Banks use certain lending criteria to decide how much they’ll loan you, but everyone’s financial situation is unique. To avoid mortgage stress, it’s particularly important to make sure that your mortgage payments are affordable for your lifestyle, and that they are manageable even if interest rates rise.

It is also important to consider the long-term costs of home ownership, which include up-front costs such as stamp duty and removals fees, along with home maintenance, rates and taxes over time.

Illawarra Grand Deluxe 45 has been furnished in our beautiful Nordic decorating theme, which offers an eye-catching mix of soft pastels, black, white and grey artworks and curvy, sculptural furniture.

What is mortgage stress?

Mortgage stress is defined as occurring when you spend more than 30% of your pre-tax income on mortgage repayments. Many buyers who bought in the past two years – when interest rates were at record lows – may now be facing mortgage stress, as the mortgage repayment to income ratio has risen. However, that definition doesn’t account for your personal circumstances. For example, families with large overheads – such as private school fees, car loans or childcare – will be less able to weather increases than those with fewer demands on their money.

On another view, high-income households have more flexibility about where their income goes and can more easily cut back. Couples with two incomes may also be in a different tax situation to households with one high-income earner and enjoy more after-tax income.

Only you know your financial situation and what it can weather. You may be able to pay more than 30% without issue or struggle even at a lower rate.

Borrow less and get more for your money with a house and land package.

How much do you need to earn to afford a house?

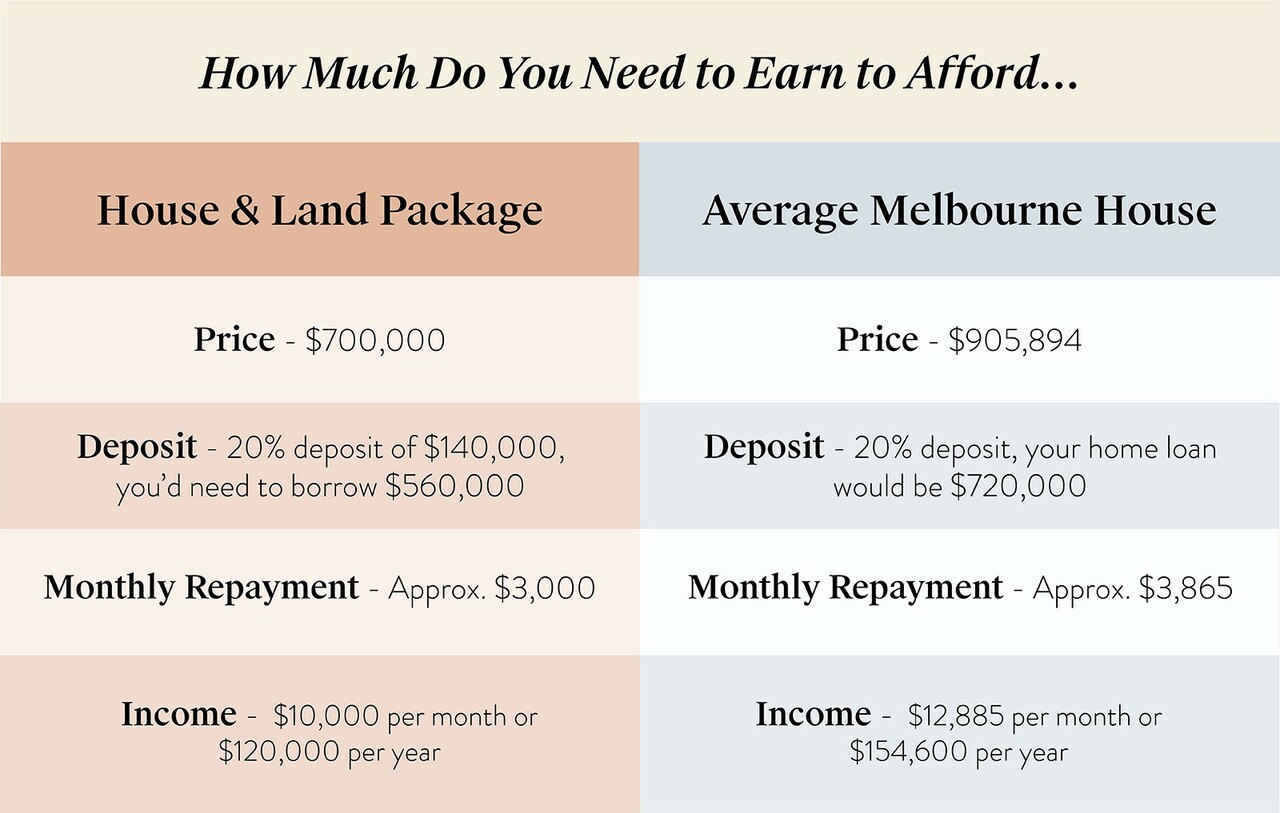

Let’s put this in perspective. CoreLogic data indicates that the median house price in metropolitan Melbourne on 31 December 2022 was $905,894 (or $752,777 across all dwellings including units and apartments)

With a 20% deposit, your home loan would be $720,000. At an interest rate of 5%, over 30 years, your monthly payment would be $3,865.12. You can calculate similar figures here.

You would need to earn at least $12,885 per month to avoid being in mortgage stress, which is a household income of $154,600.

Compare that to a house and land package that costs a more modest $700,000. With a 20% deposit of $140,000, you’d need to borrow $560,000. Your mortgage repayment would be around $3,000. Thus, you’d only require an income of $10,000 per month or $120,000 per year.

Lenders don’t use the 30% rule to determine your lending capacity, so you may be able to get an offer for significantly more. However, before you get tempted to borrow as much as possible, consider whether it’s realistic for your budget.

Stay on top of your mortgage repayments by being savvy with your financial products.

How can you avoid mortgage stress?

Apart from not borrowing too much, what other ways are there to avoid mortgage stress? Being savvy with your financial products can help:

- Avoid taking out extra debt. Credit cards and personal loans can add up quickly, and debt can spiral out of control. While the home loan is an unavoidable debt, make a commitment to keep it as the only one you hold. Everything else can be saved up for.

- Make sure your home loan package works hard for you. Offset accounts are an excellent option for some people, allowing you to keep interest down while still being able to access funds. It may be that a fixed loan offers a better deal and more certainty, or you may prefer the flexibility of variable. If you’re not sure, give your mortgage broker a call for a home loan health check.

- Keep an emergency fund on hand. It offers great peace of mind to have some cash available for an emergency. If your hot water system needs replacing, or the car breaks down, that little bit of extra cash can help you avoid high interest loans.

If you do find yourself slipping into stress, the more important thing to do is talk to your lender. They’ll work with you to explore options before the situation gets too bad.

See what else Carlisle Homes have to offer:

- View our extensive range of house plans to find your perfect home

- No land? We've done the hard work and have a curated list of house and land packages featuring premium blocks paired with our award winning homes

- Want to see us for yourself? Why not visit one of our display homes

If a dream house and land package is your goal, call Carlisle Homes on 1300 328 045. One of our in-house construction finance specialists can help you run the numbers, so you feel confident about your buying budget.