How is the Cost of Living Calculated?

The cost of living has been in the news a lot recently. But what is it, and how is it measured?

Knowing exactly what has gone up, and how that’s calculated, can help you make smarter choices about your own budget.

When we talk about the cost of living, we often mean it anecdotally. Our grocery bill has gone up, or a new car is more expensive than it used to be. But there is a more objective measure, which is used by economists and governments to determine whether they need to take action.

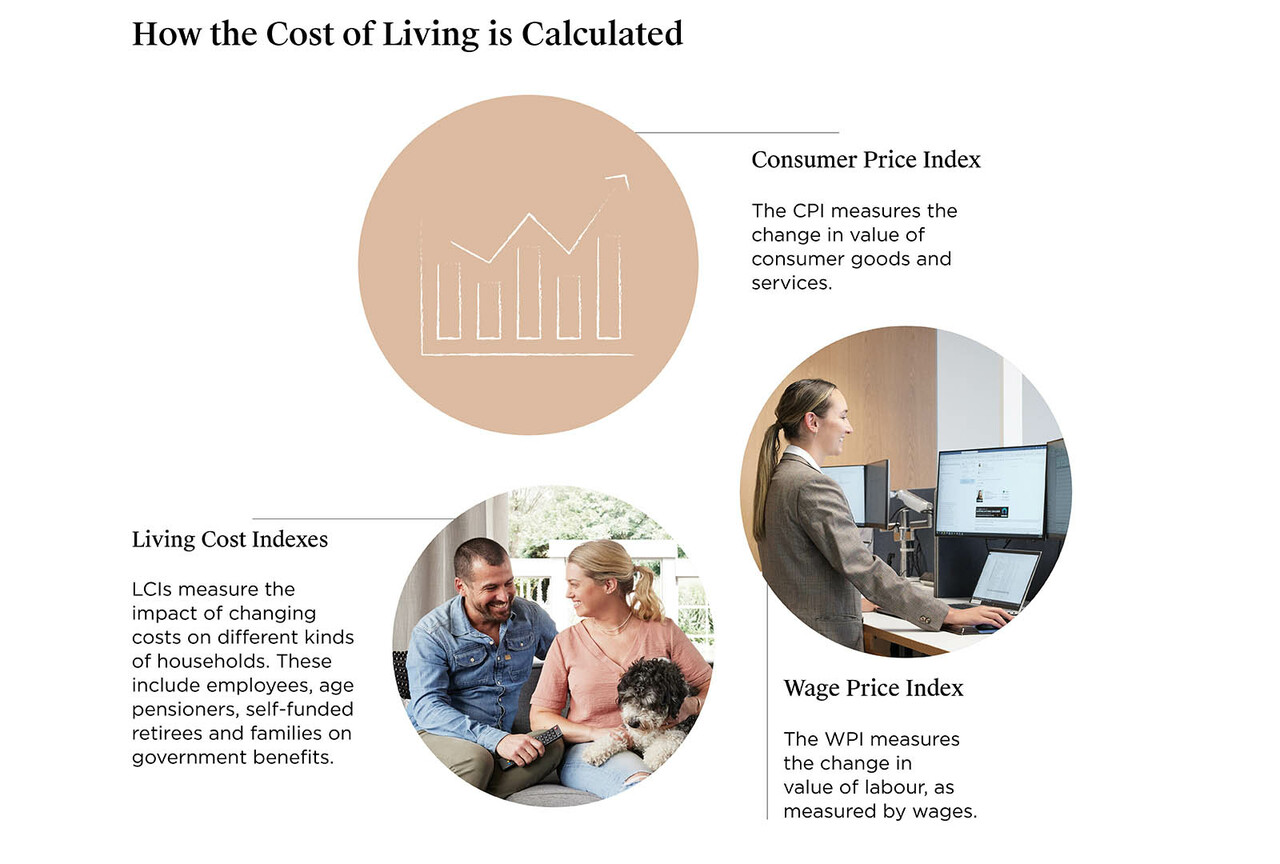

The cost of living is evaluated using three main measures. The Consumer Price Index (CPI), the Wage Price Index (WPI) and Living Cost Indexes (LCIs).

Understanding how the cost of living works can help you make smarter choices about your own budget.

Consumer Price Index

This is probably the best known of the three. The CPI measures the change in value of consumer goods and services.

To calculate this, the Australian Bureau of Statistics (the ABS) collects prices for thousands of items, grouped into 81 categories that reflect average Australian spending. This is sometimes known as the ‘CPI basket’ or ‘basket of goods’ - those things that we all need to spend money on, on a regular basis. These goods and services are weighted to reflect the proportion of our budget we spend on them. For example, housing costs are weighted at 25%, because the ABS recognises that when housing costs go up, it makes a bigger dent in our budget than if the price of shoes increases.

The list, from highest to lowest weight, is:

- Housing

- Food and beverages

- Recreation and culture

- Transport

- Furniture and household equipment

- Alcohol and tobacco

- Health

- Insurance

- Education

- Clothing and footwear

- Communication

The relationship between the CPI, WPI and LCIs gives us a broader understanding of how the cost of living shifts, and which groups are affected. Featured here: Sanctuary Grand, Smiths Lane, Clyde North.

Wage Price Index

This measures the change in value of labour, as measured by wages. Much like the CPI,’s ‘basket of items’, the WPI takes a ‘basket of jobs’ and looks at the standard wages in those sectors.

Living Cost Indexes

LCIs measure the impact of changing costs on different kinds of households. These include employees, age pensioners, self-funded retirees and families on government benefits.

It’s important to measure all three because it is the relationship between wages and costs that determines affordability. If your household expenses double and your wages only grow by 10%, you’ll probably struggle to make ends meet. If your expenses double but your wage doubles as well, it may have little or no impact.

The relationship between the CPI, WPI and LCIs gives us a broader understanding of how the cost of living shifts, and which groups are affected. This allows the government and the RBA to make informed decisions and shape their response to target the affected groups.

Make better budgeting decisions and reach your saving goals using the cost-of-living indices.

How the cost-of-living indices can help you budget

Cost of living measures may seem a little abstract, but understanding them can help you target your savings strategy. The CPI is a good indicator that some of your regular costs may have gone up. This means you can make decisions about whether to change your spending habits. At the same time, the WPI may help you decide whether it’s worth pushing for a pay rise.

Here are some quick things you can do to help:

If housing costs are rising, look at ways to keep yours down. Compare home loans to make sure you’re getting the best deal available. That might include a chat to your broker about whether to fix your rate. Insurance and utilities can also be pricy, so shop around and compare providers before deciding whether to make a switch.

Groceries are a large chunk of most household budgets. Try meal planning, cooking in bulk and swapping from expensive cuts of meat to cheaper ones. Eating a few plant-based meals a week can save some dollars even if you’re not vegetarian or vegan. You could also try shopping near the end of the day when most supermarkets and grocers discount perishable foods.

Petrol prices are at an all-time high, leaving a lot of people feeling the pinch. If it’s possible for you, try walking, cycling, or catching public transport instead of hopping in the car. Working from home can be a saving if your employer is open to it. In the market for a new car? Electric may be the way to go.

Understanding how the cost of living is calculated can help you better manage your personal expenses. Use our Cost of Living Calculator to estimate your monthly expenses and gain a clearer picture of your financial situation.

For advice on managing your finances so you’re ready to apply for a home loan, visit our in-house construction finance specialists. To find out more about buying the house and land package that suits your budget, call Carlisle Homes on 1300 328 045.