Trading Up from Family Home to Forever Home

by Janine Armstrong, General Manager - Marketing

Considering upsizing or a knockdown rebuild? Trading up your first home to your forever home might just be the way to do it!

Trading up is when home buying gets really fun. Once you’ve built up some equity in your first home, you can use it to buy something bigger, fancier or in a more desirable location.

Often families are also looking to combine some resources with older parents residing in the same place or support financially for that future opportunity. So the forever home is different for everyone's scenario but the following is one scenario.

You’re less constrained by budget or time pressure, so you can afford to be fussy. Trading up to a forever home is about enhancing your lifestyle and finding a house to suit your family. As with anything, though, that dream home does come with its own costs. So how do you know when you can afford to make the move?

Unsure whether you can afford to upgrade to your forever home? We breakdown the costs of upsizing below.

We’ve used a common scenario to help you decide.

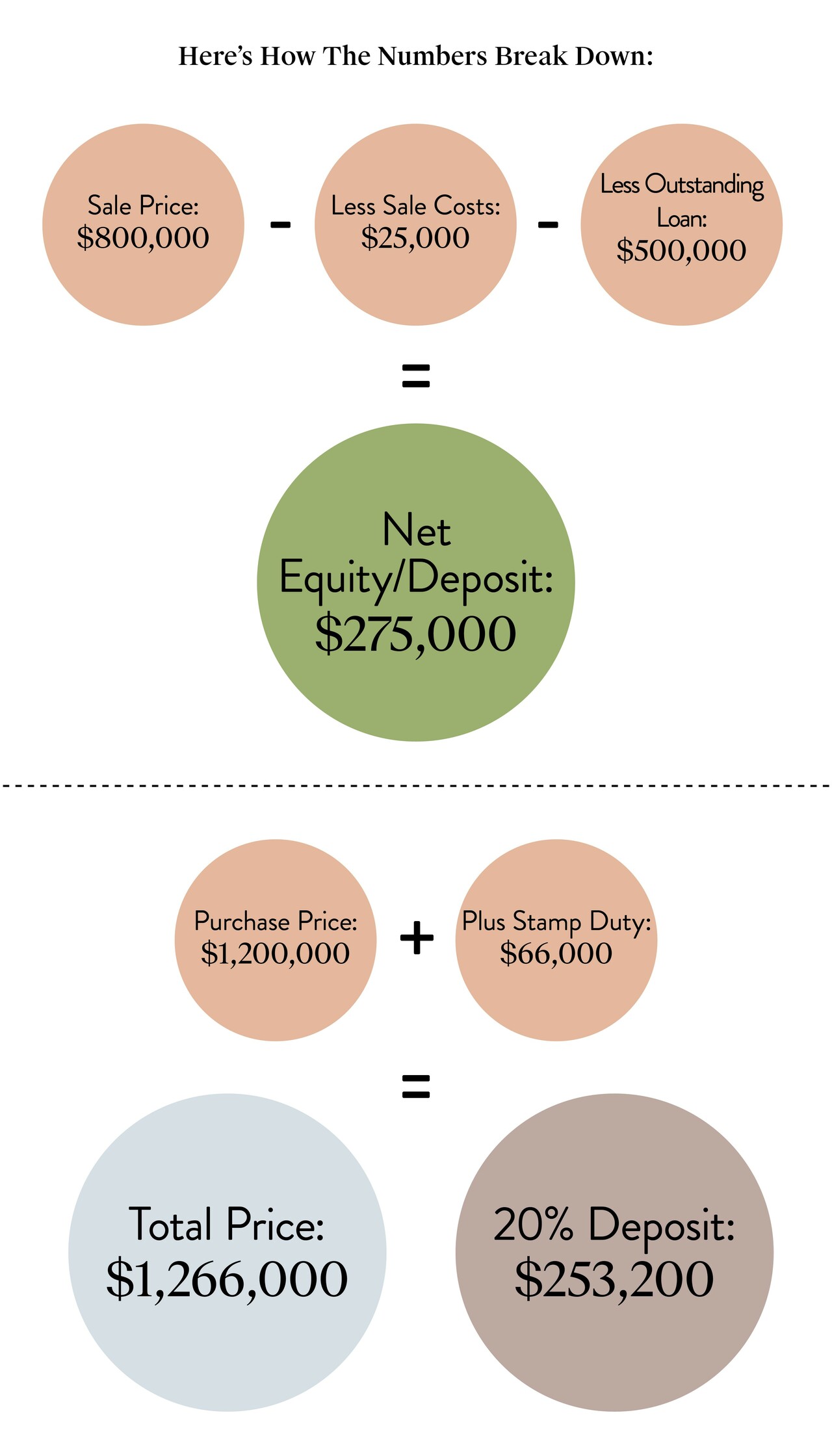

Let’s say you bought a first home for $600,000 with a deposit of 10% ($60,000). A few years have gone by, and you’ve paid down the mortgage so that you only owe $500,000. At the same time, the value of the property has gone up to $800,000. Your equity is ($800,000 - $500,000 = $300,000). That’s a substantial gain for relatively little outlay.

There are three simple steps to working out how house much you can afford, and the potential pitfalls in the process.

We’ll look at how much house you can afford with your $300,000 using the following steps.

1. Your equity should be worth at least 20% of the new purchase price.

If you want to avoid lenders’ mortgage insurance on your second property, you won’t want to exceed the golden loan-to-value ratio of 80:20. Your $300,000 deposit, therefore, represents 20% of the purchase price.

2. Setting a realistic budget including planning for stamp duty.

First home buyers who buy a home for less than $600,000 in Victoria are exempt from paying stamp duty, while those who buy a home for between $601,000 and $750,000 receive a discount.

Not so for those buying a second house. That $1.5M house, assuming a new build that is bought as your principal place of residence, carries a hefty stamp duty tag of $82,500. If you don’t have that sitting in a savings account, you’ll need to borrow the extra - meaning that your deposit is now less than 20% of the loan amount.

Lower your sights to a $1.2M home, however, and you’re back in business. The stamp duty is $66,000 and your $300,000 deposit is therefore is now over 20% of your total purchase costs ($1,266,000).

3. Factor in sale costs

Of course, you’ll need to sell your first home. Sale and marketing costs vary significantly, but you should budget for:

- Real estate commission. This is a percentage of the total sale price. It generally varies from 1% to 3%, with the average being around 2% in most capitals. If you’re selling an $800,000 property you could expect to lose $16,000 of the sale price to your real estate agent.

- Marketing costs. These are extremely variable since it depends on how extensive the marketing campaign is. However, realestate.com.au estimates the average marketing campaign in Melbourne in 2022 to be around $6500 - $8000. Assuming a $7,000 cost, you’re now down by $23,000 - more if you choose to professionally style the home.

- Conveyancing fees. These can vary from $800 to $2000. Assume $1,500 to be safe.

- Auction fees. You don’t have to sell by auction, but if you do, you’re out another $1,000.

Ready to upgrade? Please feel free to speak to our loan experts to make your forever home a reality. Featured here: Astoria Grand 55, Attwell Estate, Deanside.

In total, the cost of selling your home will sit at around $25,000, cutting your deposit from $300,000 to $275,000.

That $1.2M home requires a $240,000 and you’ll be able to afford it comfortably with some room in the budget as you settle in.

We breakdown the numbers so that you can calculate the purchase price of your upgrade and the total price of your deposit.

The takeaway?

If you have calculated the true purchase price (including stamp duty), and your true net equity is still within 20% of that price, you may be ready to move. Take your time and find somewhere that will suit your family in the long term - as we’ve established, moving can cost a pretty penny. Don’t forget to tuck a little aside for some new furniture, too. A new house deserves a housewarming present!

A great place to start at package prices is our T-Range double-story homes which are designed for true family living with plenty of space to make forever dreams come true for the whole family.

Ready to upgrade to the dream house and land package? Call Carlisle Homes on 1300 535 416. Our in-house construction finance specialists can help you run the numbers, so you feel confident about your buying budget.

Janine Armstrong

General Manager - Marketing

By designing innovative digital tools and empowering homeowners with knowledge, Janine makes the journey of building a new home easier and more rewarding.

Learn more about Janine Armstrong