How Much Deposit Do You Need to Buy a Home?

When it comes to buying a new home, the deposit is often seen as the biggest barrier—and the most misunderstood. Many assume a 20% deposit is the golden rule, but the reality is far more flexible.

Watch the second episode of The Finance Essentials—a three-part video series by Carlisle Homes—industry experts break down what a deposit looks like for first-home buyers today. Spoiler alert: it’s probably less than you think.

Watch Now: Discover how much deposit you need to buy your dream home!

Watch Now: Discover how much deposit you need to buy your dream home!

Do you really need a 20% deposit?

It’s a common belief that buying a home means saving up 20% of the property’s value. While that’s the ideal amount to avoid specific fees like Lenders Mortgage Insurance (LMI) and higher interest rates, it’s not a hard and fast rule.

In fact, many first-home buyers and even seasoned investors can secure a loan with as little as 5%, a much more achievable figure, especially with the help of government incentives.

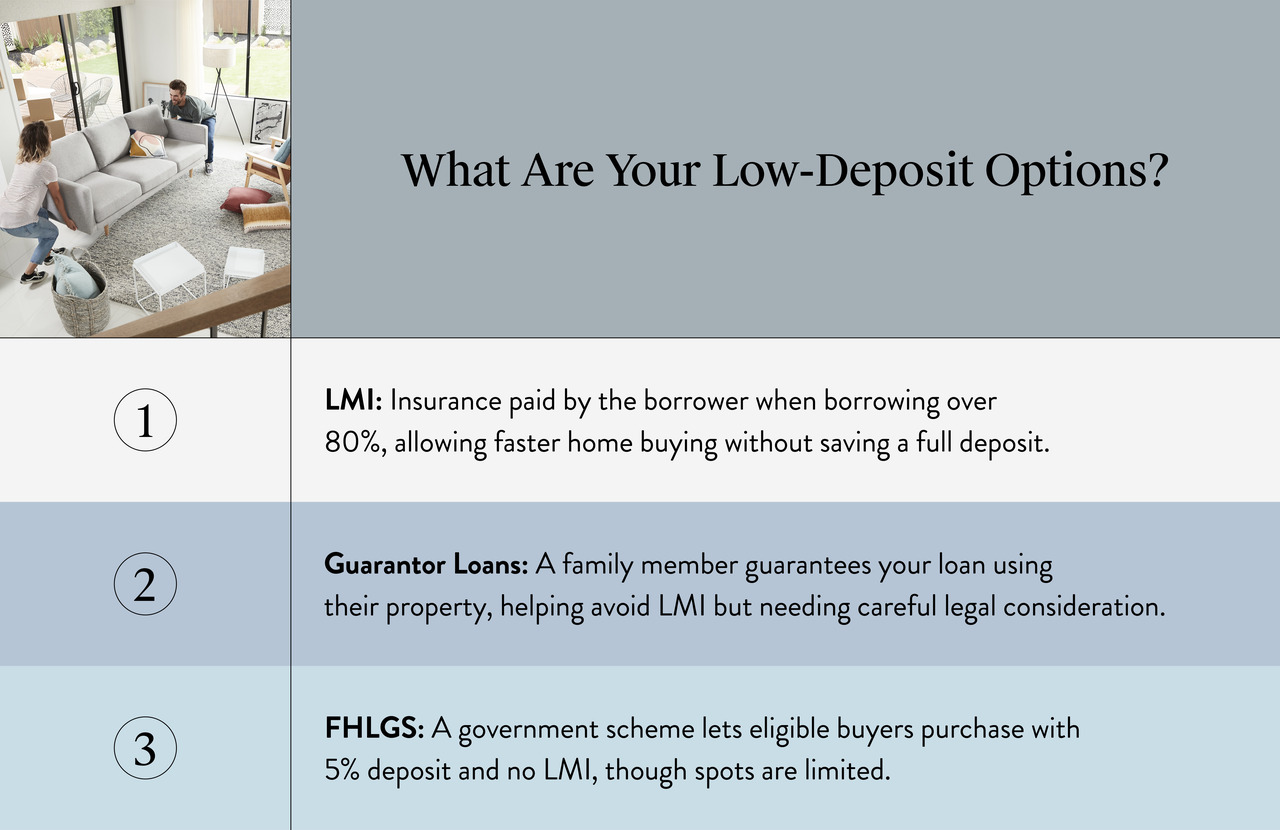

Understanding your low-deposit options

Not everyone has the full 20% saved, and securing a home with a smaller deposit might be required to get a foot onto the property ladder. Lenders offer a range of solutions to bridge the gap, from low-deposit home loans with LMI added to the loan amount, to alternative pathways.

Each option has its own pros, cons, and considerations, but all share the same goal: helping buyers get into a home sooner.

First Home Buyers can take advantage of lower deposit options.

Breaking down the pathways

LMI: This is an insurance for the lender triggered when borrowing more than 80% of a home’s value. While the borrower pays it by adding it to your overall loan, it can help fast-track your purchase, often making more sense than spending extra years saving the remaining 15%.

Guarantor Loans: A parent or relative can act as guarantor for those with family support, using their own home as security. This can help avoid LMI altogether and potentially reduce your overall interest rate, but it’s a decision that should be made carefully, with independent legal advice.

First Home Loan Guarantee Scheme: This government program, along with a selection of other similar schemes, allows eligible buyers to purchase with just a 5% deposit, and pay no LMI. With limited spots available for the 2024–25 financial year, it’s worth checking if you qualify and sourcing a broker familiar with the scheme.

You could be buying your dream home sooner than you think.

Finding the right fit

There’s no one-size-fits-all approach to deposits. Whether taking out a low-deposit loan, leaning on family support, or applying for a government scheme, each pathway offers different advantages depending on your circumstances.

The most important step? Knowing your options and talking to a qualified finance expert to find the approach that suits you best. For a quick, personalised estimate, try Carlisle’s Finance Calculator to see how much deposit you might need for your dream home.

Ready to make sense of home deposits? Watch Episode Two of The Finance Essentials for clear, expert-led advice that could bring your dream home closer.