Saving Solo? You’ll Have Your House Deposit in No Time!

by Carlisle Homes

Saving for a house deposit on a single income can feel like an impossible task, but don’t lose hope! There are plenty of benefits to flying solo, and we’re here to tell you exactly what they are.

Being single definitely has its advantages. You can watch whatever you want on TV, the only dirty socks you’re picking up are your own, and if you want to book an impromptu weekend away in the Maldives, who’s to stop you?

Of course, when you’re trying to save for the big things – like a house deposit – two incomes are better than one. Saving a house deposit is the biggest hurdle most people face on the way to home ownership, and when you’re flying solo, it’s even more of a challenge. That doesn’t mean it’s impossible, though – in fact, there are quite a few hidden benefits…

Discover the hidden benefits of saving on a single income. There are more than you might think!

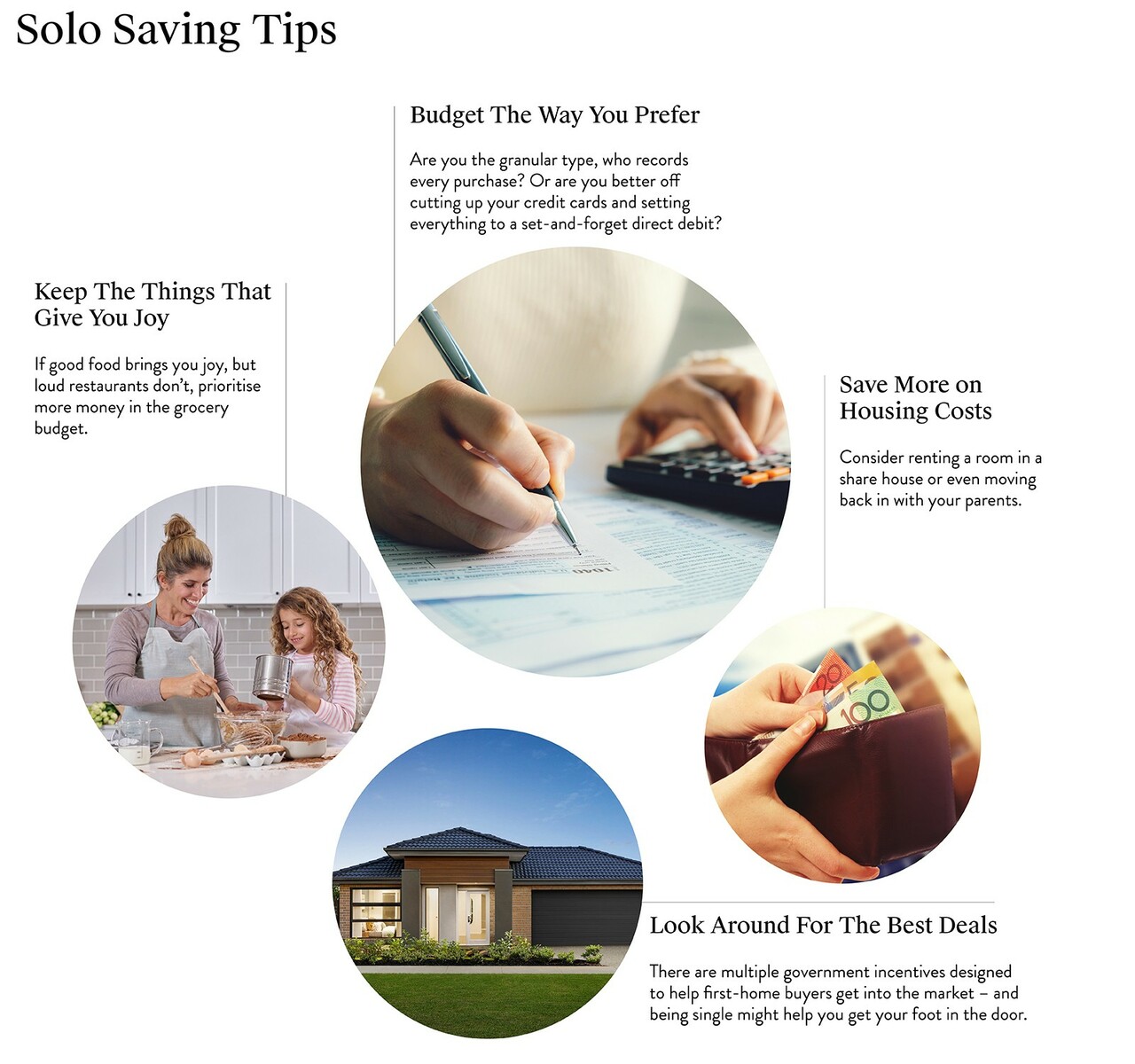

Keep the things that give you joy

There are no two ways about it: saving is hard. That’s why we advocate for a thoughtful approach to budgeting that focuses on what’s really important to you. This allows you to give yourself some leeway on the things that matter, so you can cut back on the rest.

For example, if good food brings you joy, but loud restaurants don’t, it makes sense to prioritise a little more money in the grocery budget and cut back on entertainment. You can also get creative and find new ways to save – like scouring op shops for great-value vintage finds or teaching yourself to repair your own car.

Budget the way you prefer

Being single also means the way you budget can be tailored to your individual preferences. Are you the granular type, who likes to record every purchase? Or are you better off cutting up your credit cards and setting everything to a set-and-forget direct debit?

With a partner in the mix, these types of decisions become harder. If one of you cherishes gourmet restaurants and the other is happy with beans on toast, it can be a recipe for resentment. Your detailed budgeting may chafe on a partner who hates thinking about dollars and cents, whereas their penchant for investing may trigger your debt aversion. Single budgeters may have fewer dollars to work with, but they usually have more control over how it’s used.

Flying solo gives you more choice on where you live. Consider downsizing or sharing with friends or family.

Save more on housing costs

Rent is usually the biggest budget item for those trying to save. To really power up your savings, consider renting a room in a share house or even moving back in with your parents. Again, this is an area where it’s easier if you’re single. There are very few married couples who want to be shacking up with their parents, but as a singleton, it might be worth the sacrifice.

Even if you are stuck renting, you can look for a smaller space. Two people might be tripping over each other in a studio apartment, but if it’s just you? You can stay up as late as you like watching Netflix without worrying about disturbing your partner’s sleep.

Look around for the best deals

And we don’t just mean bargain purchases here. There are multiple government incentives designed to help first-home buyers get into the market – and many of them are only available if you’re single.

Firstly, there’s the First Home Owner Grant, which offers $10,000 towards the cost of buying or building a new home. However, you can only access it if both you and your partner have never owned property in Australia before. This means that many partnered people will miss out.

As a singleton, you can still reap all the rewards of government incentives like the First Home Owner Grant and the Home Guarantee Scheme.

Secondly, the Home Guarantee Scheme (formerly the First Home Deposit Scheme) allows you to secure a home loan with a 5% deposit and not pay lenders’ mortgage insurance. Again, you and your partner must both be first homeowners. The income cap is $125,000 for a single person or $200,000 for a couple.

Lastly, if you’re a single parent you may be eligible for the Family Home Guarantee scheme. This option allows you to secure a home loan with an even lower deposit of just 2%. You must be a single parent – emphasis on single – with at least one dependent child to apply.

Budgeting as a single person definitely requires some compromise. Your borrowing power will be lower because you will probably have less available for repayments. However, don’t underestimate the power of being your own boss. You get to decide how hard to budget and what to cut back on. And best of all, when you’ve finally got that deposit in the bank, you can choose your dream home and land package just the way you like it!

Did you find this Home Files blog helpful?

Don't forget to bookmark it so you can revisit it later!

Need a little more help to get your finances in order? Contact our our in-house construction finance specialists.